San Antonio Real Estate Market Update – November 2025

How did the San Antonio housing market perform in November 2025? What should buyers and sellers know heading into 2026? As a local REALTOR® with 18 years of experience in the San Antonio area, I'm breaking down the latest market data so you can make smarter, more informed decisions.

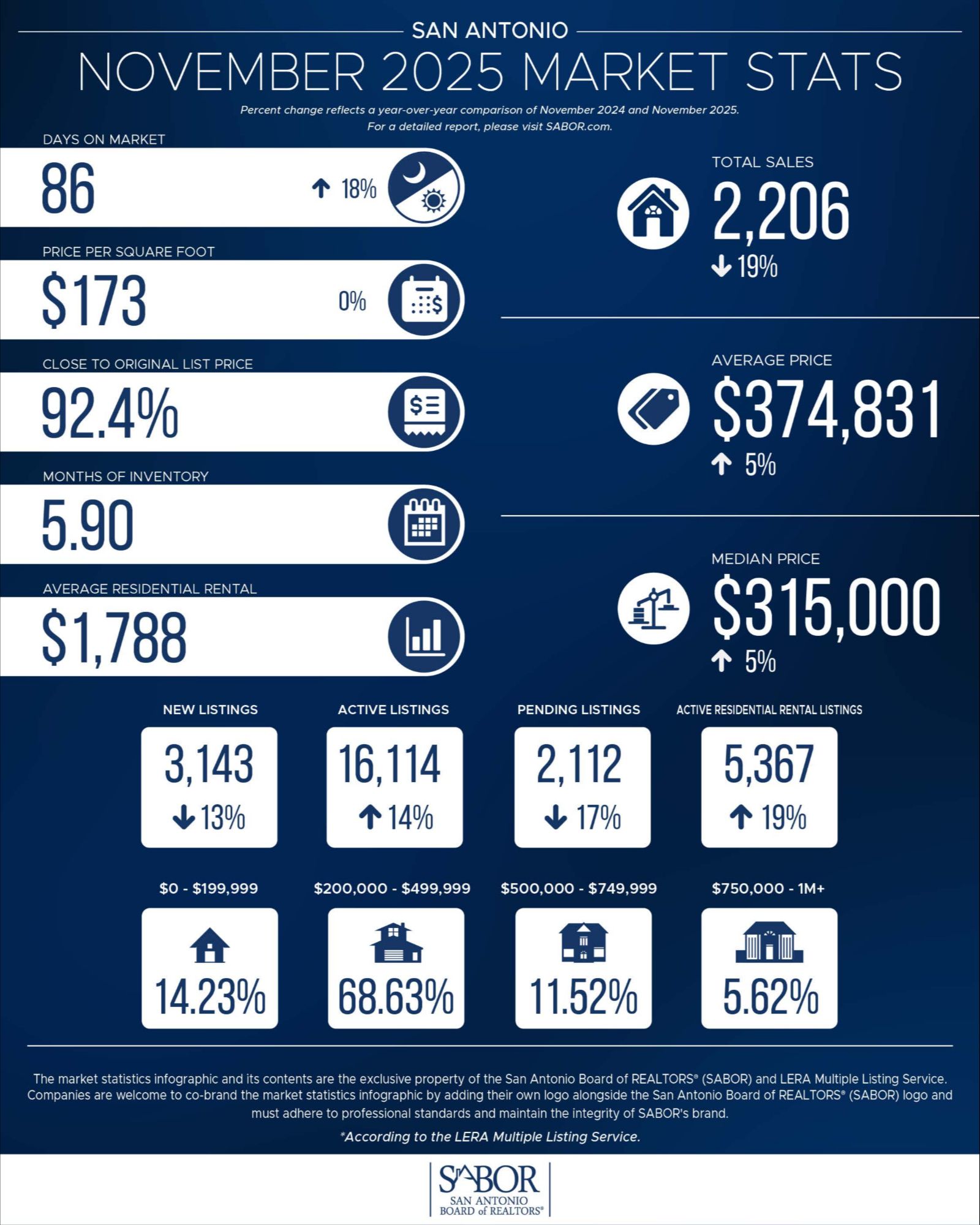

The latest statistics from the San Antonio Board of REALTORS® (SABOR) offer a revealing snapshot of current trends — from price movement to inventory shifts — and what they could mean for you as a buyer or seller.

Key Market Highlights – November 2025

According to SABOR’s November 2025 Market Stats report:

- Total Sales: 2,206 homes sold — a 19% decrease year-over-year

- Average Sales Price: $374,831 — down 5% from November 2024

- Median Sales Price: $315,000 — also down 5%

- Price per Square Foot: $173 — unchanged from last year

- Average Days on Market: 86 days — up 18%, indicating a slower-moving market

- Close-to-Original List Price Ratio: 92.4%, suggesting sellers are adjusting expectations

- Months of Inventory: 5.9 months — approaching a balanced market

- Active Listings: 16,114 — up 14%

- New Listings: 3,143 — down 13%

- Pending Sales: 2,112 — down 17%

- Average Residential Rent: $1,788

- Active Rental Listings: 5,367 — up 19%

What Does This Mean for Buyers?

If you're in the market to buy, this winter could offer opportunity:

- Prices have softened slightly year-over-year — especially compared to the rapid appreciation we saw from 2020–2022.

- More inventory means less competition and more negotiating room.

- With nearly 6 months of inventory, we're in a more balanced market — a welcome change from the red-hot seller’s market of the past few years.

That said, the average close-to-list price ratio still sits above 92%, so you’ll need to come prepared with strong offers for well-priced homes.

What Sellers Should Know

The market is still active — but not as fast-paced:

- Homes are spending longer on the market — 86 days on average.

- A slight drop in sale prices and fewer pending sales signal buyers are more cautious.

- Pricing right and prepping your home for market matters more than ever — especially if you're in a higher price bracket.

Sellers targeting the $200K–$500K range are in the sweet spot, with nearly 69% of sales falling into this category. Homes under $200K made up 14%, while homes over $750K made up just 5.6%.

Rental Market on the Rise

If you’re considering holding property as an investment, the numbers are encouraging:

- Average residential rent: $1,788

- Active rental listings: 5,367 — up 19% year-over-year

As affordability challenges persist for some buyers, demand for rentals remains high, particularly in the more affordable northeast and northwest corridors.

What This Means Going Into 2026

We’re entering a more normalized, data-driven market — not the frenzy of past years. That’s a good thing for both sides of the transaction.

- Buyers have more options and some price relief, especially with proper guidance and negotiation strategy.

- Sellers can still win — with smart pricing, presentation, and the right marketing approach.

In short: it’s a market where knowledge, strategy, and experience matter more than ever.

Let’s Talk About Your Next Move

Whether you're buying, selling, or just planning your next steps — I’m here to help you navigate the numbers and the neighborhoods.

Mark Stillings, Associate Broker, M.B.A.

210.772.3123

mark@markstillings.com

TikTok: @markstillingsrealtor

Instagram: @mark_stillings

YouTube: @markstillings

Categories

Recent Posts